GST In Exports | What is LUT, IGST Refund, Features (Full Guide)

Exporting goods and services is a vital aspect of India’s economy, and understanding the Goods and Services Tax (GST) implications is crucial for exporters. This guide delves into the essentials of GST in exports, focusing on the Letter of Undertaking (LUT), Integrated Goods and Services Tax (IGST) refunds, and other pertinent features.

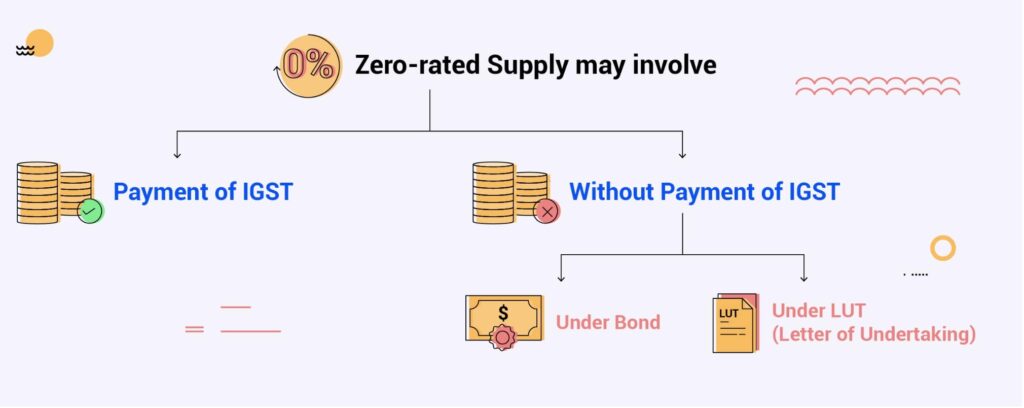

Understanding Zero-Rated Supplies under GST in Exports

Under the GST regime, exports are classified as zero-rated supplies. This classification implies that while the exported goods or services are taxable, the tax rate applied is 0%. Consequently, exporters can claim a refund on the GST paid on inputs used in the production of exported goods or services, ensuring that taxes do not become a cost component in international trade.

Why Does the Indian Government Offer Zero GST on Export Products?

The Indian government offers zero GST on exports to promote international trade by making Indian products more competitive globally. It helps exporters reduce costs and avoid double taxation, boosting their profitability. This initiative also enhances foreign exchange earnings and contributes to the country’s economic growth.

1. To Boost Export Growth

Zero GST reduces export costs, encouraging Indian businesses to expand internationally. This helps increase India’s export volume and supports overall economic growth.

2. Enhancing Global Competitiveness

It makes Indian products cheaper abroad, helping them compete with global brands. This boosts demand for Indian exports and strengthens the country’s position in the international market.

3. Preventing Double Taxation

Zero-rating avoids double taxation, keeping Indian exports affordable in foreign markets. It ensures that Indian exporters are not burdened with taxes both in India and in the importing country.

4. Increasing Foreign Exchange Earnings

Exports bring in foreign currency, strengthening India’s forex reserves. This contributes to a favorable balance of payments and stabilizes the national economy.

5. Economic Growth and Employment Opportunities

More exports increase demand for labor and raw materials, creating jobs. It stimulates related industries, driving economic development and reducing unemployment.

6. Compliance with International Trade Norms

Zero GST follows global trade norms, ensuring smoother international transactions. It keeps Indian exports competitive and compliant with international tax standards.

7. Encouraging Ease of Doing Business

It simplifies tax compliance, making it easier for businesses to export. Reduced paperwork and faster refunds enhance the overall export experience for traders.

Exporting Under LUT/Bond Without Payment of IGST

Exporters have the option to export goods or services without the payment of IGST by furnishing a Letter of Undertaking (LUT) or a bond. This approach facilitates liquidity and eases the compliance burden.

What is a Letter of Undertaking (LUT)?

An LUT is a document that allows exporters to undertake exports without the payment of IGST, committing to adhere to all GST provisions. It’s a simpler alternative to the bond, primarily used by exporters with a clean track record.

Eligibility for LUT

As per the guidelines, any registered person who intends to supply goods or services for export without payment of IGST can furnish an LUT, provided they:

- Have not been prosecuted for any offense under the GST laws or any existing laws where the amount exceeds ₹250 lakh.

- Comply with the prescribed conditions and safeguards.

Procedure to Furnish LUT

- Access the GST Portal: Log in to the GST common portal.

- Navigate to LUT Application: Go to Services > User Services > Furnish Letter of Undertaking (LUT).

- Fill in the Details: Enter the required information and upload the necessary documents.

- Submit with Digital Signature: Complete the process by signing digitally.

The LUT is valid for the entire financial year in which it is furnished. If an exporter fails to comply with the LUT conditions, they may be required to pay IGST along with interest.

Exporting with Payment of IGST and Claiming Refund

Alternatively, exporters can choose to pay IGST on exported goods or services and subsequently claim a refund. This method might be beneficial for those who prefer to utilize input tax credits immediately.

Steps to Claim IGST Refund

- File Shipping Bill: The shipping bill filed with Customs serves as a refund application for IGST paid on exports.

- File GST Returns: Ensure that GSTR-1 (details of outward supplies) and GSTR-3B (summary return) are filed correctly, reflecting the export transactions.

- Validation and Processing: Upon filing the Export General Manifest (EGM) and the relevant GST returns, the Customs system validates the details. Once validated, the refund process is initiated, and the amount is credited to the exporter’s bank account.

It’s imperative to ensure that the details in the shipping bill and GST returns match accurately to avoid delays in refunds.

Merchant Trader GST on Purchase and IGST Refund: Complete Guide

As a merchant trader, when you purchase goods from manufacturers for export, you are eligible for a concessional GST rate of 0.1%. This special rate is designed to encourage exports by minimizing the cost burden on traders. Here’s how the process works:

- Purchase at 0.1% GST:

- Merchant traders can buy goods from manufacturers at a reduced GST rate of 0.1% by providing the manufacturer with a copy of the purchase order and an undertaking to export the goods within 90 days.

- The manufacturer must mention ‘Supply meant for export on payment of GST @ 0.1%’ on the invoice.

- Exporting the Goods:

- The purchased goods must be exported within 90 days from the date of the invoice.

- Shipping bills and export invoices should clearly mention the GST paid at 0.1%.

- Claiming IGST Refund:

- The merchant trader can claim a refund of the IGST paid (0.1%) by filing a refund application on the GST portal using Form RFD-01.

- Necessary documents required include:

- Shipping bill

- Export invoice

- Bank Realization Certificate (BRC)

- Proof of export (Bill of Lading/Airway Bill)

- Verification and Processing:

- The GST department verifies the documents and cross-checks the details with customs data.

- If all documents are in order, the refund is processed within 60 days.

- Important Points to Remember:

- If the goods are not exported within 90 days, the concessional rate benefit is withdrawn, and the merchant trader will have to pay the differential tax amount.

- Proper documentation and timely filing are crucial for a smooth refund process.

Example: Merchant Trader GST on Purchase and IGST Refund

ABC Exports is a merchant trading company in India. They purchase 1,000 T-shirts from a manufacturer at a cost of ₹200 per T-shirt. Under the concessional GST rate, they pay 0.1% GST instead of the regular 12%. Here’s how the process goes:

- Purchase at 0.1% GST:

- ABC Exports provides the manufacturer with a purchase order and an undertaking to export the goods within 90 days.

- The manufacturer issues an invoice stating:

- Cost of T-shirts: ₹200,000 (₹200 x 1000 T-shirts)

- GST @ 0.1%: ₹200 (0.1% of ₹200,000)

- Total Invoice Amount: ₹200,200

- The invoice clearly mentions: “Supply meant for export on payment of GST @ 0.1%”

- Exporting the Goods:

- ABC Exports ships the T-shirts to a buyer in the USA within 90 days.

- The shipping bill and export invoice clearly show that 0.1% GST was paid on the purchase.

- Claiming IGST Refund:

- ABC Exports applies for an IGST refund on the GST portal using Form RFD-01.

- They provide the following documents:

- Shipping Bill

- Export Invoice

- Bank Realization Certificate (BRC) confirming receipt of payment in foreign currency

- Bill of Lading as proof of export

- Verification and Processing:

- The GST department verifies the documents and matches the details with customs records.

- If everything is correct, the refund of ₹200 is processed within 60 days.

- Important Points to Remember:

- If ABC Exports fails to export the goods within 90 days, they must pay the difference between the concessional rate (0.1%) and the regular GST rate (12%).

- Proper documentation and timely application are essential for a smooth refund process.

Key Features and Considerations

- Zero-Rated Supply Benefits: Exporters are entitled to claim refunds on unutilized input tax credits, enhancing competitiveness in the global market.

- Timely Compliance: Adhering to timelines for filing LUTs, bonds, and GST returns is crucial to avail benefits without interruptions.

- Documentation: Maintaining accurate records and documentation facilitates smooth processing of refunds and compliance verification.

For a deeper understanding of export-related benefits, you may also explore our other blogs on Duty Drawback Schemes and RODTEP Schemes, which provide insights into additional incentives available to exporters.

FAQs on Zero GST in Export Products

Why does India offer zero GST on export products?

The Indian government offers zero GST on exports to enhance the global competitiveness of Indian products by reducing costs. It also prevents double taxation and boosts foreign exchange earnings.

Is GST charged on all types of export products?

No, exports of goods and services are considered ‘zero-rated supplies’ under GST, meaning no GST is charged on them.

Do I need to pay GST first and then claim a refund for exports?

Exporters have two options: they can either export under a Letter of Undertaking (LUT) without paying GST or pay IGST at the time of export and later claim a refund.

What is a Letter of Undertaking (LUT) in GST for exports?

LUT is a document exporters submit to the GST department to export goods or services without paying IGST. It serves as a guarantee of compliance with export rules.

How can exporters claim GST refunds on exports?

Exporters can claim refunds by filing Form RFD-01 on the GST portal after verifying the shipping bills and export invoices.

Is GST applicable on goods exported to Nepal or Bhutan?

No, exports to Nepal and Bhutan are also considered zero-rated under GST, provided payment is received in foreign currency.

Can exporters of exempt goods claim GST refunds?

No, exporters of exempt or non-GST goods cannot claim GST refunds since no tax is paid on their inputs.

What documents are needed to claim GST refunds on exports?

Required documents include the shipping bill, export invoice, Bank Realization Certificate (BRC), and the LUT (if applicable).

How long does it take to get a GST refund for exports?

Usually, the GST refund is processed within 60 days of filing the refund application, provided all documents are in order.

Are there penalties for misuse of zero GST benefits on exports?

Yes, misuse of zero-rated GST benefits can result in penalties, interest on unpaid tax, and other legal consequences under the GST law.

If you want to learn import-export from basics to advanced, including company formation, import-export documents, product research in exports, finding foreign buyers, pre-shipment and post-shipment documentation, GST in exports, payment terms, Incoterms, and more, then watch this 7-hour video by Mr. Keshav Dimri, a successful exporter and brilliant marketer working since 2017.